By now, you’ve likely watched the webinars and read all about the 2024 Giving USA report. (Hopefully that includes our very own Lynn Gaumer’s expert analysis!)

Do you still have questions about how all this data applies to your organization? Join us this month as our Stelter strategists break down the report by nonprofit subsector.

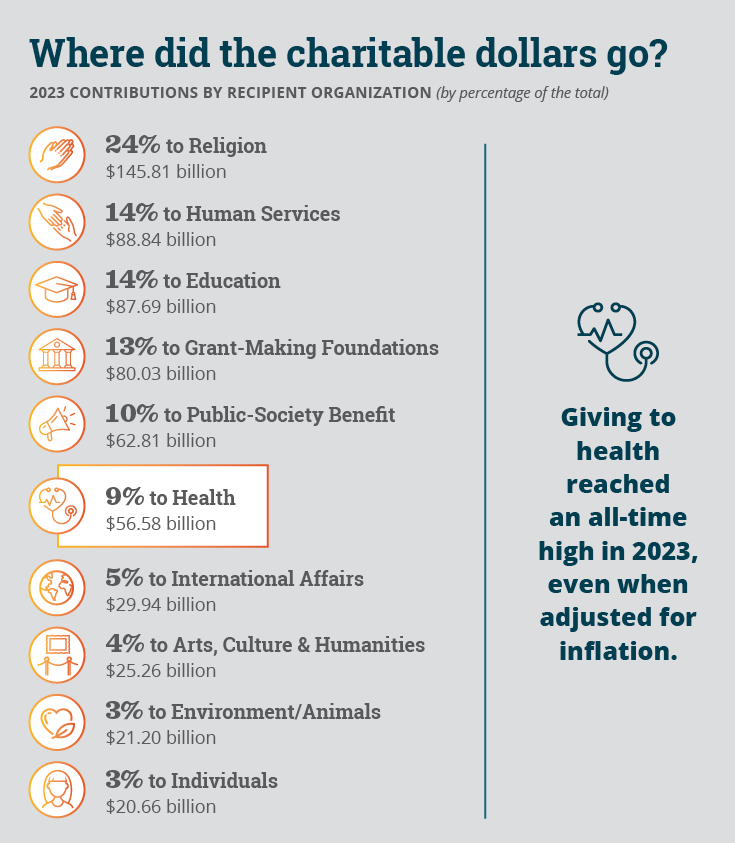

Health Giving: By the Numbers

Giving to health reached $56.58 billion last year. That’s an increase of 8.7% in 2023, or a 4.4% increase adjusted for inflation.

And that’s its highest inflation-adjusted value ever! Health was one of five subsectors (out of nine) to reach its all-time high last year.

Health is the sixth-largest piece of the charitable pie, receiving a 9% share of the total giving to nonprofit subsectors. Giving to the health subsector has comprised between 6% and 10% of the total over the last four decades.

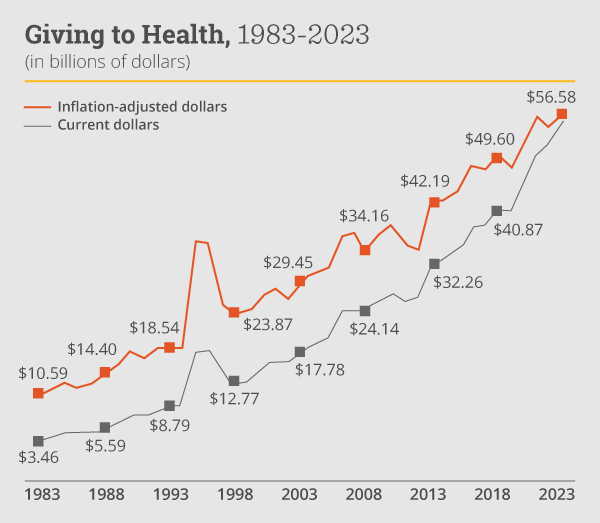

Not only has the health subsector reached its highest level of giving in 2023, it has also maintained a positive five-year growth rate (although that growth has been tempered year-over-year by inflation.)

Here you can see the positive trend lines over the last 40 years.

Where Is the Money Coming From?

Giving USA identified several sources:

Individual major gifts and foundation funding – This remains the largest source of support by a significant margin, while Giving USA also notes that major gift composition is shifting. Gifts of $10 million or greater continued to decline last year. And CCS Fundraising notes in its “2024 CCS Philanthropy Pulse” report that 41% of healthcare organizations surveyed receive 20% of their gifts as noncash assets.

Ultra-high-net-worth donors – Megadonors like Michael Bloomberg and MacKenzie Scott were name dropped in the report and acknowledged for including health organizations in their giving.

Planned, corporate, and annual gifts, as well as government grants – These are all part of the pie but yielded lower portions of 2023 support. The Association for Healthcare Philanthropy’s (AHP) “2023 Report on Giving” indicates that planned giving is the third largest source of philanthropy funding, at 18% for the organizations they surveyed.

Grateful patients – People who have positive experiences at hospitals and healthcare systems, as well as the desire and ability to give back, support the health subsector in many ways. This attitude of gratitude benefits others and the donors themselves.

Online revenue – This channel grew 4% last year, according to the sample of health organizations in the “2024 M+R Benchmarks Study.” That median growth was the highest M+R reported across all subsectors.

Donor advised funds – There’s much talk about the popularity of DAFs, but the data shows that grants are not distributed equally. Health is fifth on the list, receiving a 9% share of DAF grant dollars in 2023. (Education received the largest share at 25%, and human services, religion, and public-society benefit all got more from DAFs than health.)

Peer-to-peer fundraising – Established events remained steady, while other participation rates varied, some fluctuating and some down. This continues to raise questions about the viability of event fundraising and corporate revenue streams in the health subsector.

Where Is the Money Going?

Giving USA highlighted two areas in particular:

Youth mental health – Many academic and institutional reports have released data indicating that child and adolescent mental health are in a state of national emergency. Health organizations and their donors are working to respond accordingly to this crisis.

Biomedical research and application – From new vaccines and immunizations, to gene-editing therapies and novel medications, to AI and chatbots (and more!), donors should know that their giving has the potential to help transform the health subsector for generations to come.

The report also noted two areas where philanthropic support is lagging: nursing and reproductive health.

What’s the Outlook?

In the “2024 CCS Philanthropy Pulse” report, respondents shared that donor acquisition and retention are the top fundraising challenges in the health subsector. Operational challenges also include insufficient staffing, board engagement, and economic uncertainty.

Diversity, equity, accessibility, and inclusion (DEAI) continues to be an opportunity for investment. CCS survey respondents emphasized the importance of DEAI in strategic planning and staff/board training related to fundraising.

Giving USA reports that, despite some challenges, the overall climate for giving to health organizations is favorable: “Donors’ continued commitment to the diverse landscape of healthcare philanthropy is clearly demonstrated through the expansion of funding for youth mental health, philanthropic support for biomedical research advancements, and the continued rise and sophistication of fundraising focused on grateful patients.”

Key Takeaways

Giving USA provides this to-do (and don’t-do) list of strategies for healthcare organizations of all shapes and sizes:

- Do embrace technology

- Do cultivate relationships

- Do follow up

- Don’t overlook donor stewardship

- Don’t neglect your online presence

- Don’t discount the power of volunteers

I’ve seen real-world examples of most of the report’s findings in my day-to-day work with healthcare and medical research clients at Stelter. A consistent planned giving program can help you tackle this list and lean into the challenges and opportunities highlighted above.

P.S. Will we see you at AHP’s International Conference in San Diego next month? Be sure to stop by the Stelter booth and meet our team! You can hear more from Kasi at her Express Talk on Thursday 11/7, “Growing Love: Our North Star for Legacy Giving.”

More from Kasi

[…] Stelter’s breakdown of the report highlights the top sources of this funding: […]