Stelter’s Senior Gift Planning Consultant, Lynn M. Gaumer, J.D., CAP®, offers her analysis of how and where Americans gave last year as reported in Giving USA 2025: The Annual Report on Philanthropy for the Year 2024.

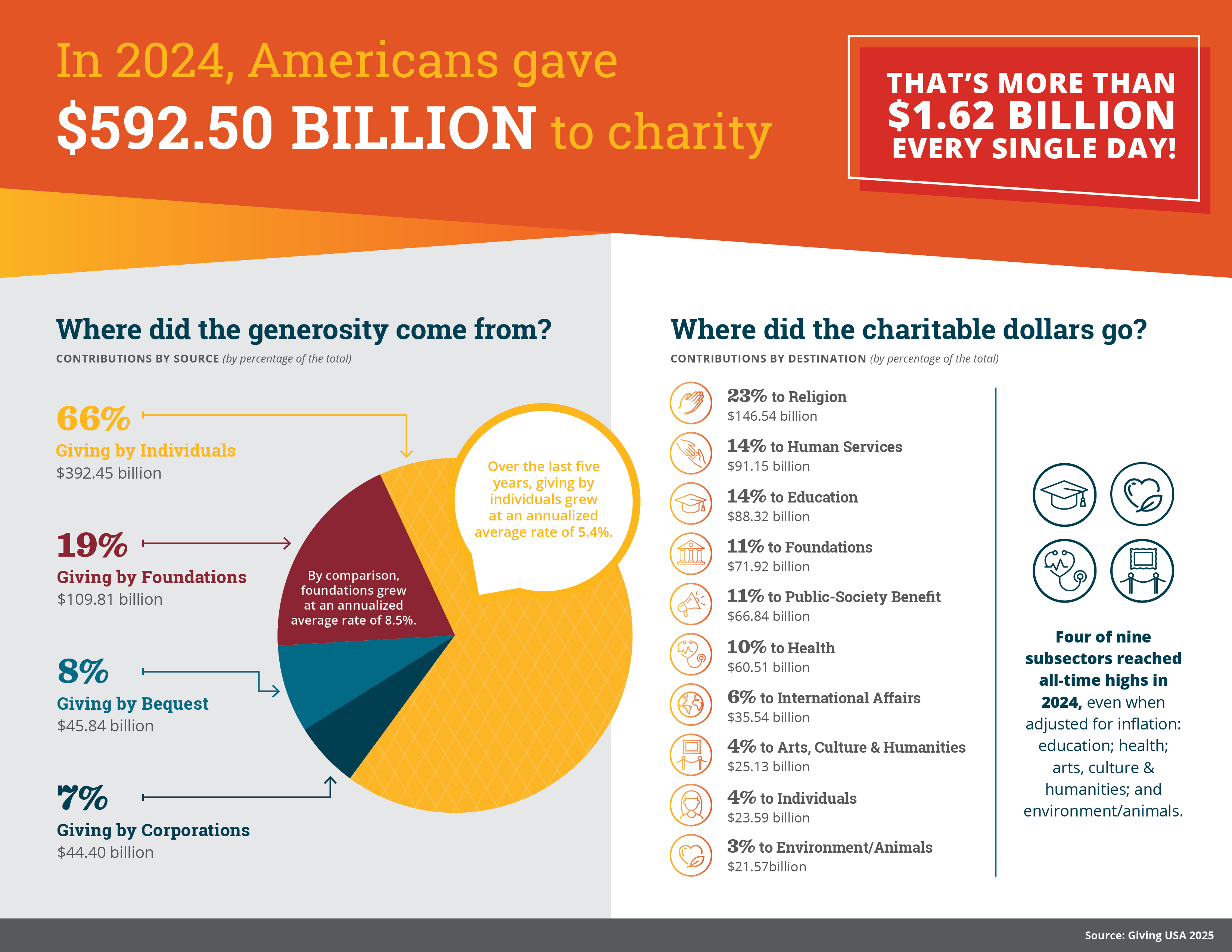

Charitable giving reached a record $592.50 billion (in current dollars) in 2024, according to the just-released Giving USA report. This staggering figure is a testament to American generosity.

The new report not only demonstrates Americans’ steadfast commitment to philanthropy but also provides significant insights into how and where these contributions are making a profound impact.

The numbers in the latest report are important—but it is also essential to understand how tax policy, economic shifts, societal changes and emergent technologies have influenced donor behavior and charitable contributions over time. By comparing current figures with historical data, we can discern patterns, fluctuations and the enduring priorities that shape the landscape of giving in the United States.

Let’s dive into how and where Americans gave in 2024, look back to uncover trends and, finally, look ahead for our recommendations on navigating the latter half of this year.

The Big Picture

The new numbers say that after considering individual donations, corporate donations, bequests and foundation giving, Americans gave $592.50 billion in 2024—a 6.3% increase in current dollars (3.3% when adjusted for inflation).

That’s more than $1.62 billion every single day.

If you combine the individual and bequest numbers, individuals contributed about 74% of all dollars given to charity in 2024. This is a key number to use when trying to make your case to start or expand a planned giving program at your organization.

Who Is Giving?

Individuals continue to be the backbone. They gave $392.45 billion in 2024 and represented 66% of all charitable giving. That’s a 8.2% increase over the previous year (5.1% when adjusted for inflation). Contributions included gifts of cash, securities and property.

Giving by foundations is growing, amounting to $109.81 billion—19% of all contributions made in 2024. That’s a 2.4% increase over the previous year (though a small decrease of 0.5% when adjusted for inflation). Giving by foundations crossed the $100 billion mark for the third consecutive year.

More than $45.84 billion was given via bequests, a decrease of 1.6% from 2023 (down 4.4% when adjusted for inflation). These gifts are the most volatile form of giving. The yearly total tends to fluctuate based on the estates of high-net-worth donors and is less influenced by economic factors. You should continue to promote gifts in wills and trusts, as they provide a solid foundation for any planned giving program.

The data shows that corporate giving increased 9.1% from 2023 (6% when adjusted for inflation) and represented just over $44.40 billion. Although corporate giving remains the smallest source, it reached an all-time high in inflation-adjusted terms. Corporate giving includes cash and in-kind contributions made through corporate giving programs as well as grants and gifts made by corporate foundations.

Where Are Charitable Dollars Going?

Giving grew in seven of the nine major recipient subsectors (with four reaching all-time highs) while two subsectors either remained flat or declined when adjusted for inflation.

Three sectors saw double-digit growth in current dollars:

- Public-society benefit led the way in 2024, growing by 19.5% to $66.84 billion (16.1% when adjusted for inflation). This sector includes a wide range of organizations, including national donor advised funds (DAFs) such as Fidelity Charitable. This may account for the growth in this sector.

- International affairs grew by 17.7% to $35.54 billion (14.3% when adjusted for inflation).

- Education grew by 13.2% to $88.32 billion (9.9% when adjusted for inflation), an all-time high.

Five sectors saw single-digit growth in current dollars, even when adjusted for inflation:

- Arts, culture and humanities grew by 9.5% to $25.13 billion (6.4% when adjusted for inflation), an all-time high.

- Environmental and animal organizations grew by 7.7% to $21.57 billion (4.6% when adjusted for inflation), an all-time high.

- Human services grew by 5% to $91.15 billion (2% when adjusted for inflation).

- Health grew by 5% to $60.51 billion (2% when adjusted for inflation), an all-time high.

Giving to foundations grew by 3.5% to $71.92 billion (staying relatively flat at 0.5% when adjusted for inflation).

Only one sector grew but did not outpace inflation: Religion grew by 1.9% to $146.54 billion but was down 1% when adjusted for inflation. However, this sector still received the largest share of charitable dollars at 23% of total giving.

Get the Report

To learn more about the sources and uses of charitable donations this past year, read the Giving USA Foundation press release or subscribe to Giving USA to access the full report.

Take a closer look at who gave and where the dollars went in our infographic below and download the PDF to refer to later.

Click image to enlarge

A Look Back: Reflecting on American Philanthropy

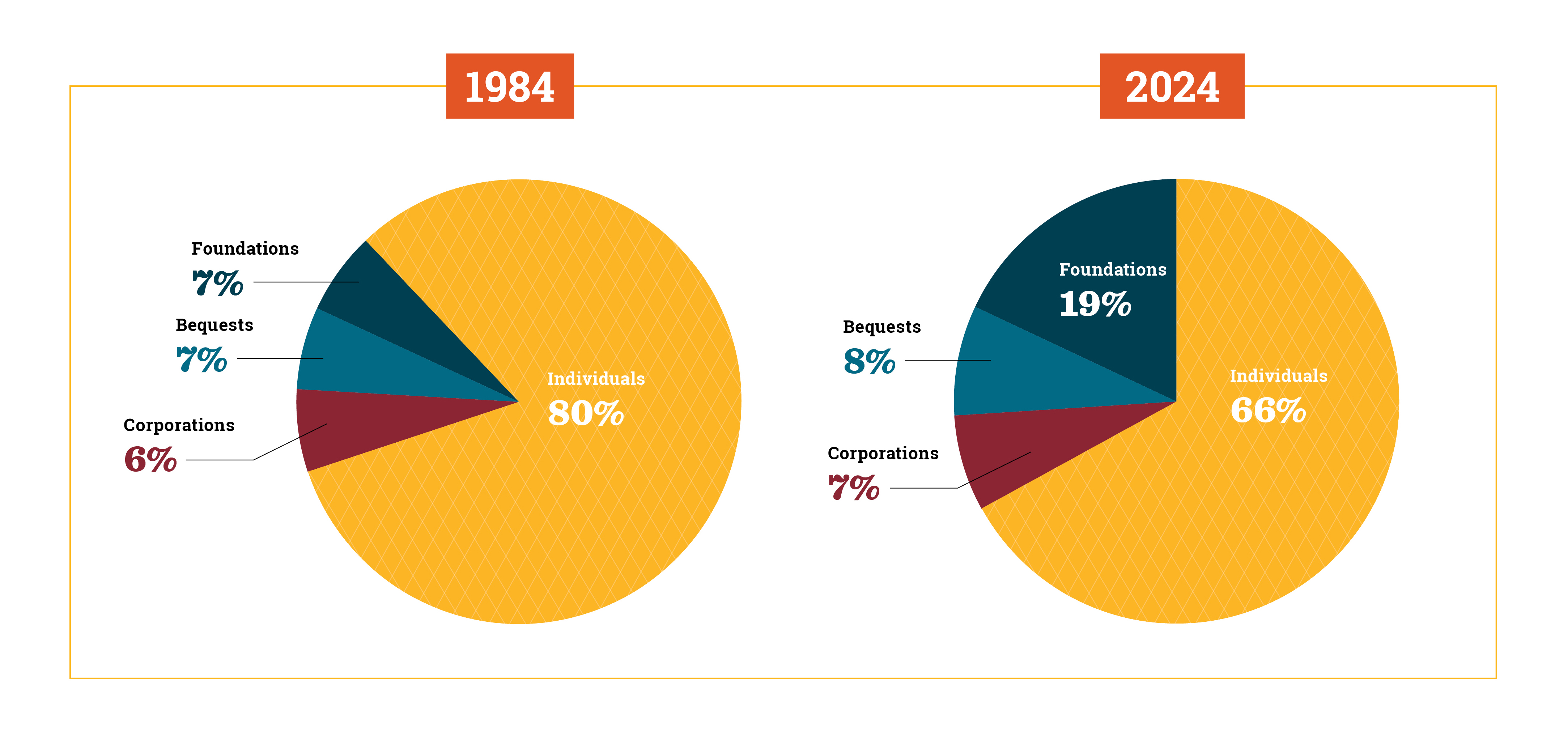

Comparing these figures to past years reveals a compelling narrative. Over the past decade, we’ve seen fluctuations in giving patterns influenced by factors such as tax policy, the economy, a pandemic, natural disasters and shifts in social priorities. First, let’s compare the sources of giving over a 40-year period and see whether any trends emerge.

Giving Sources: Key Takeaways

Giving by individuals is shrinking as a share of giving over the last 40 years, from about 80% in 1984 to 66% in 2024. Several factors are driving this shift. Economic uncertainty, inflation and concerns about personal financial stability may be causing some households to pull back on charitable contributions. Additionally, the higher standard deduction under the Tax Cuts and Jobs Act of 2017 reduced the number of taxpayers who itemize—and with it, the tax incentive to give. Generational shifts also play a role: Younger donors tend to give differently, often prioritizing direct action over traditional nonprofit structures. Finally, a growing concentration of giving among high-net-worth individuals may be masking a broader disengagement among everyday donors. To reverse this trend, nonprofits need to think creatively about donor engagement, trust-building and demonstrating impact. Find a few tips here from Giving USA and near the end of this blog.

According to Giving USA, charitable bequests have consistently represented between 7% and 9% of total giving in the United States over the past four decades—a testament to the enduring role of gifts in a will in philanthropy. In 2024 alone, bequest giving totaled an estimated $45.84 billion. While annual totals can fluctuate due to estate settlement timing, the long-term stability of bequest giving highlights how planned gifts remain a vital and reliable source of support for nonprofits. This steady presence underscores the importance of engaging donors in legacy conversations; many people choose to make the most significant gifts of their lives through their estate plans.

Not only did giving by foundations experience significant growth over the last year, but its share of giving has surged from about 7% in 1984 to 19% in 2024. Foundations include grants made by independent, community and private foundations. This increase can be attributed in part to steady asset growth. According to the latest report by Foundation Mark, U.S. foundations’ assets rose by about $170 billion (about 11.5%) in 2024, pushing assets to a record $1.64 trillion.

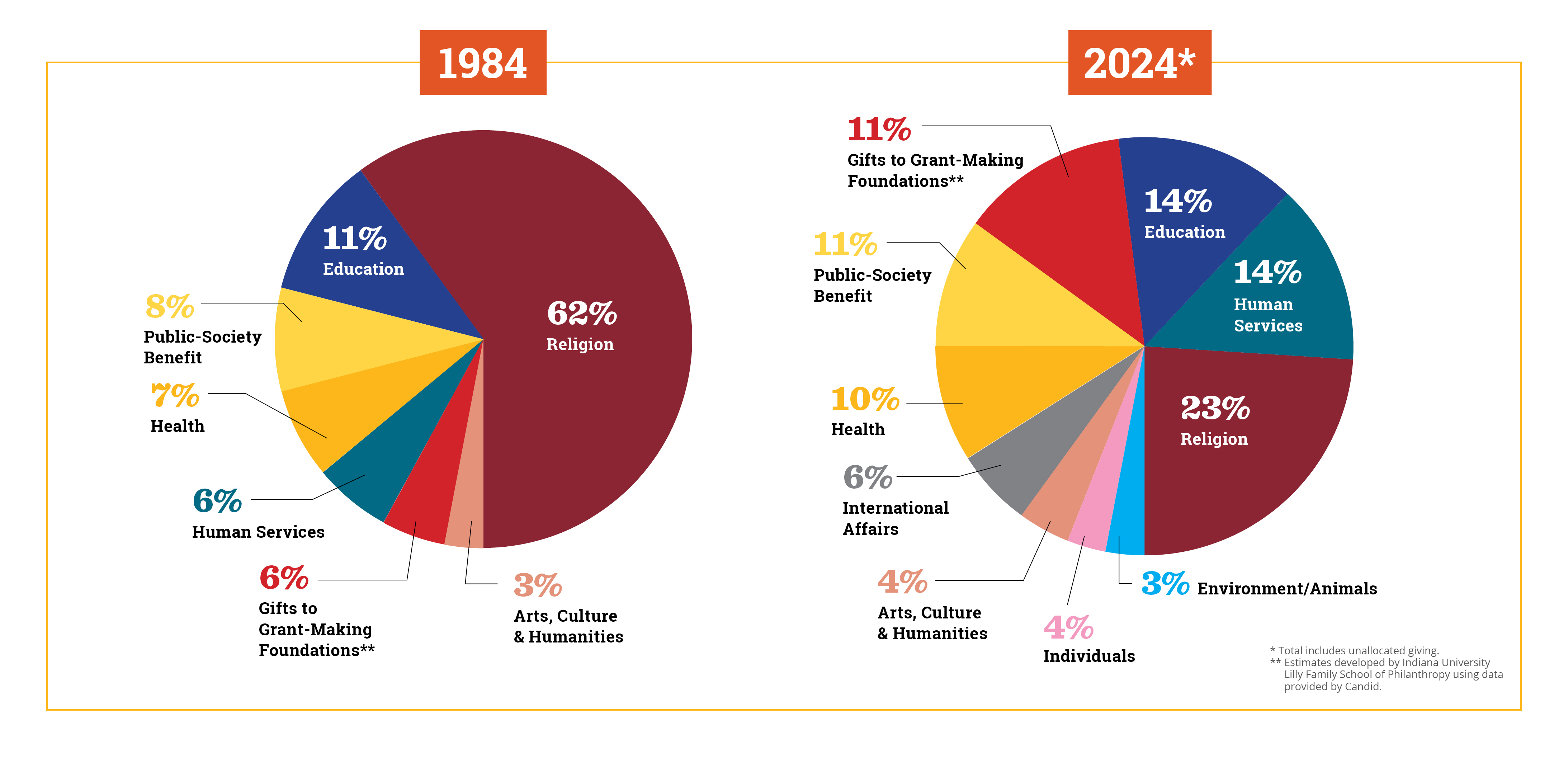

Now let’s examine giving sectors over a 40-year period.

Giving Sectors: Key Takeaways

Religion continues to receive the largest share of charitable dollars, totaling an estimated $146.54 billion in 2024. However, religion’s overall share of total giving has steadily declined over time—from 62% in the 1984 to just 23% in 2024. According to Gallup, church attendance has declined in most U.S. religious groups. This shift reflects broader cultural and philanthropic trends, including declining religious affiliation and increased giving to other sectors such as education, human services and public-society benefit organizations. Notably, while DAF donors support a wide variety of causes, religious organizations remain among the most supported. Fidelity Charitable’s Geography of Giving (pdf download) reports that 48% of their donors recommend at least one grant to a religious house of worship, underscoring that faith-motivated giving is still strong—though increasingly channeled through more flexible giving vehicles like DAFs rather than traditional weekly offerings. And if you look at the Fidelity 2024 Giving Report (pdf download), religion receives the most percentage of DAF grants compared to any other charitable sector. These organizations should promote DAFs in their promotional material. Data shows that the percentage of givers who donate to religion mirrors the number of people who report church membership.

Good news for giving in the education sector. Not only was education one of the sectors that reached its all-time high in 2024 (even when adjusted for inflation), but its share of giving has increased from 11% to 14% over the last 40 years. And according to the Fidelity 2024 Giving Report, education received the second-highest percentage of DAF grant dollars among all sectors, just behind public-society benefit.

The human services sector has also seen considerable growth. Over the past 40 years, it has grown from just 6% of all charitable giving to 14%. According to the Chronicle of Philanthropy, human services organizations consistently rank highest on the America’s Favorite Charities list. Philanthropic support continues for community support programs, racial justice, food insecurity, affordable housing and many other important causes as demand increases. In addition, online growth has helped human services organizations build their donor base and deepen their pool of major and planned gift donors.

Giving to the health sector reached an estimated $60.51 billion in 2024, representing about 10% of all charitable giving. While this share has remained relatively stable over time, the sector has benefited from increased donor interest in medical research, patient care, mental health and pandemic-related needs. Aging baby boomers and personal experiences with illness have also driven legacy giving to hospitals and health foundations. DAFs continue to play a key role, underscoring the sector’s relevance in both immediate and long-term philanthropic planning.

For a deeper dive into the Giving USA numbers for these and other sectors, sign up for my complimentary webinar on September 9, when I will host a panel discussion with our client strategists.

A Look Ahead: Challenges and Strategies for the Latter Half of This Year

To navigate the second half of 2025, the philanthropy sector needs to keep an eye on these key areas:

- Potential tax policy changes: The Big Beautiful Bill Act is making its way through Congress. Keep an eye on the Stelter blog for future updates. Once it’s signed into law, I will analyze key provisions and explain how these changes will affect donors and nonprofits.

- Executive actions: Organizations relying on government funding, particularly those whose missions do not align with the current administration’s agenda, may face reduced or eliminated funding and increased competition for grants.

- Economic conditions: Americans’ views on the economy in 2025 are mixed, with some optimism about potential growth but also concerns about tariffs, inflation, rising costs and potential recessionary risks.

What can you do to keep up the momentum and spur donations in 2025? Here are five recommendations for the final six months of the year:

- Promote gifts after a donor’s lifetime. Donors who remained concerned about inflation or the stock market may be more open to gifts after their lifetimes, such as gifts in a will or beneficiary designations. Encourage percentage giving. A fixed sum does not allow for changes in the estate’s value or for inflation.

- Encourage gifts from donor advised funds. DAFs remain a very strong gift vehicle. During periods of economic uncertainty, donors may wish to recommend grants from funds that have already been set aside. According to the National Philanthropic Trust 2024 DAF Report, there is an estimated $250 billion in DAFs. If you are not promoting DAFs, you are missing out on a large segment of donors.

- Highlight qualified charitable distributions. According to the Investment Company Institute, Americans have an estimated $17 trillion invested in individual retirement accounts. Combine that data with the fact that 10,000 boomers celebrate their 65th birthday every day, and it’s the perfect time to promote these tax-advantaged gifts from an IRA.

- Retain new donors. According to a CCS Fundraising survey and article, 70% of respondents said donor acquisition or retention are top challenges. So how can you address these challenges? CCS recommends a multi-step process:

- Examine the trends

- Assess your organization’s data

- Segment your audiences

- Develop compelling content

- Set measurable goals

- Strategically budget for success

- Keep it simple

- Build trust. A survey by Morning Consult highlighted in the Chronicle of Philanthropy says that only 56% of Americans express trust in nonprofits. You can build trust several ways.

Yearly numbers are important, but so are the overall trends that show us the bigger picture. Past and present Giving USA numbers show that planned giving remains a critical component of your fundraising efforts.

Where Planned Giving Fits In

Your organization’s success depends in part on staying the course with planned giving outreach. If it does not have a planned giving program or it’s time to expand or relaunch, use this latest data to garner support from your board of directors.

[…] talk numbers. According to the Giving USA 2025 report, charitable bequests totaled almost $46 billion in 2024 (more than the total amount contributed by […]