Stelter’s Senior Gift Planning Consultant, Lynn M. Gaumer, J.D., offers her analysis of how and where Americans gave in 2023 as reported in Giving USA 2024: The Annual Report on Philanthropy for the Year 2023.

Charitable giving reached a record-breaking $557.16 billion (in current dollars) in 2023, according to the just-released Giving USA report. This staggering figure is a testament to American generosity.

The new report not only demonstrates Americans’ steadfast commitment to philanthropy but also reveals significant insights into how and where these contributions are making a profound impact.

The numbers in the latest report are important—but it is also important to understand how economic shifts, societal changes and emergent technologies have influenced donor behavior and charitable contributions over time. By comparing current figures with historical data, we can discern patterns, fluctuations and the enduring priorities that shape the landscape of giving in the United States.

Let’s dive into how and where Americans gave in 2023, look back to uncover trends and, finally, look ahead for our recommendations on navigating the latter half of this year.

The Big Picture

The new numbers say that after considering individual donations, corporate donations, bequests and foundation giving, Americans gave $557.16 billion in 2023—a 1.9% increase in current dollars (but down 2.1% when adjusted for inflation).

That’s more than $1.52 billion given per day.

If you combine the individual and bequest numbers, individuals contributed about 75% of all dollars given to charity in 2023. This is a key number to use when trying to make your case to start or expand your planned giving program.

Who Is Giving?

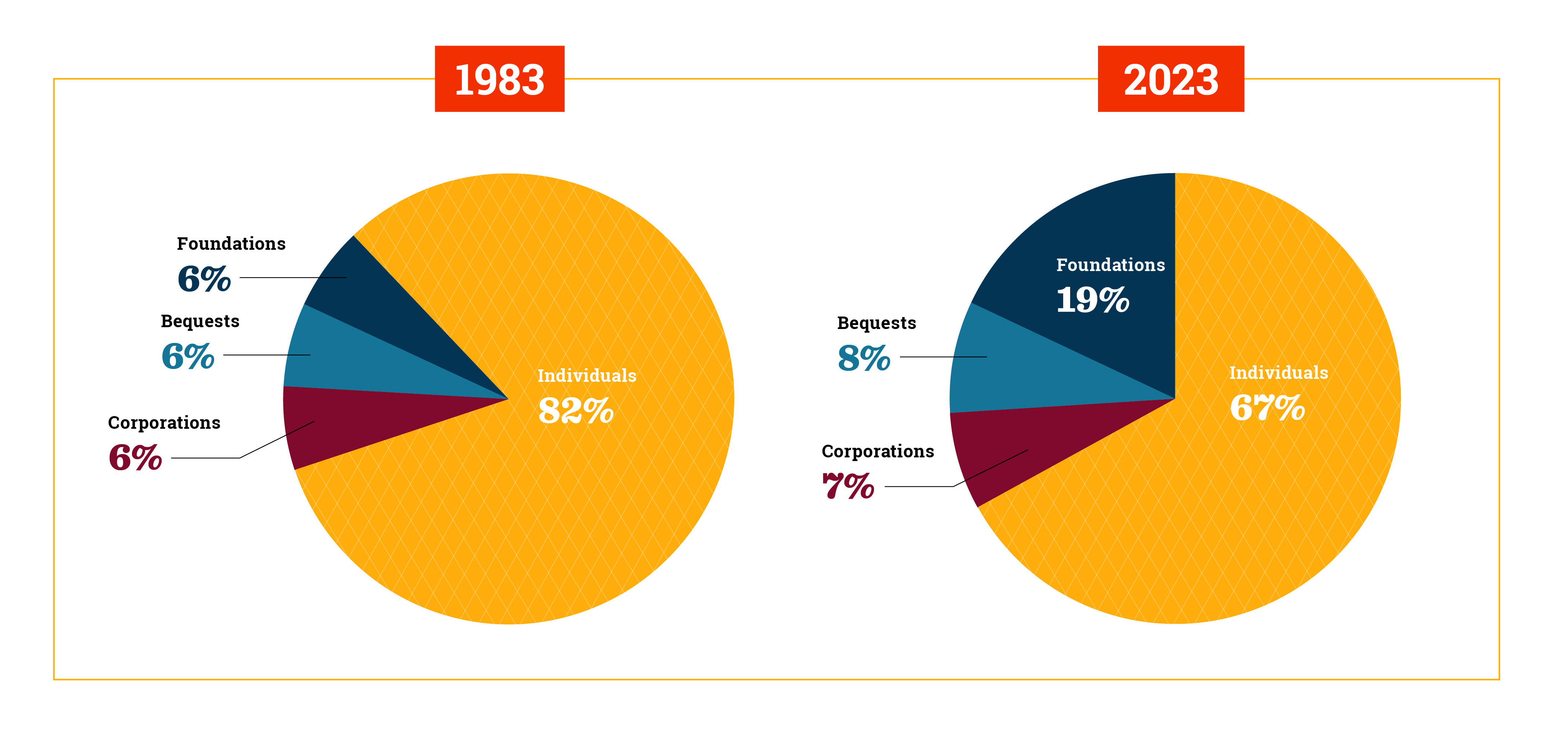

Individuals continue to be the backbone. They gave $374.40 billion in 2023 and represented 67% of all charitable giving. That’s a 1.6% increase over the previous year (though a 2.4% decline when adjusted for inflation).

Giving by foundations is growing, amounting to $103.53 billion—19% of all contributions made in 2023. That’s a 1.7% increase over the previous year (though a 2.3% decline when adjusted for inflation). Giving by foundations crossed the $100 billion mark for the second consecutive year.

More than $42.68 billion was given via bequests, an increase of 4.8% from 2022 (remaining relatively flat, with a small increase of 0.6% when adjusted for inflation). These gifts are the most volatile form of giving. The yearly total tends to fluctuate based on the estates of high-net-worth donors and is less influenced by economic factors. You should continue to promote gifts in wills and trusts, as they provide a solid foundation for any planned giving program.

The data shows that corporate giving increased 3% from 2022 (but declined 1.1% when adjusted for inflation) and represented just over $36.55 billion. Although corporate giving remains the smallest source, it is also the fastest-growing category over time. The five-year annualized average growth rate is 14.3%.

Where Are Charitable Dollars Going?

Giving grew for seven sectors even when adjusted for inflation. Five of nine sectors (human services; education; health; arts, culture and humanities; and environment/animals) reached all-time highs in 2023, even when adjusted for inflation!

Four sectors saw double-digit growth in current dollars:

- Giving to foundations led the way in 2023, growing by 15.4% to $80.03 billion (an increase of 10.8% when adjusted for inflation).

- Giving to public-society benefit grew by 11.6% to $62.81 billion (an increase of 7.2% when adjusted for inflation).

- Giving to education grew by 11.1% to $87.69 billion (an increase of 6.7% when adjusted for inflation).

- Giving to arts, culture and humanities grew by 11% to $25.26 billion (an increase of 6.6% when adjusted for inflation).

Three sectors saw single-digit growth in current dollars:

- Giving to health grew by 8.7% to $56.58 billion (an increase of 4.4% when adjusted for inflation).

- Giving to environmental and animal organizations grew by 8.2% to $21.20 billion (an increase of 3.9% when adjusted for inflation).

- Giving to human services grew by 5.8% to $88.84 billion (an increase of 1.7% when adjusted for inflation).

Only two sectors grew but did not outpace inflation: religion (up 3.1% to $145.81 billion but down 1% when adjusted for inflation) and international affairs (grew 2.5% to $29.94 billion but declined 1.6% when adjusted for inflation).

Get the Report

To learn more about the sources and uses of charitable donations this past year, read the Lilly Family School of Philanthropy press release or subscribe to Giving USA to access the full report.

Take a closer look at who gave and where the dollars went in our infographic below and download the PDF to refer to later.

Click image to enlarge.

A Look Back: Reflecting on American Philanthropy

Comparing these figures to past years reveals a compelling narrative. Over the past decade, we’ve seen fluctuations in giving patterns influenced by factors such as the economy, a pandemic, natural disasters and shifts in social priorities. First, let’s compare the sources of giving over a 40-year period and see whether any trends emerge.

Giving Sources: Key Takeaways

Giving by individuals is shrinking as a share of giving over time. Demographics may come into play here. Younger generations may see donating money as one of many important ways they can make a difference. (Another way might be donating their time for a political or social movement through volunteering.) An alternate way Americans are making a difference is through impact investing. According to Fidelity Charitable (pdf download), this practice continues to surge across all generations. Finally, according to the Fundraising Effectiveness Project in association with the Association of Fundraising Professionals, the number of donors and the donor retention rate have declined. What can the nonprofit community do to reverse this trend? For starters, you can find a few tips here and near the end of this blog.

Giving by bequests is increasing. According to Giving USA, demographic and economic factors indicate that this trend will continue. According to the U.S. Census Bureau, there are more than 77 million Americans age 60 or older. The wealth of adults age 55 or older grew 30% from 2021 to 2023, according to the Federal Reserve’s Survey of Consumer Finances. And don’t forget about boomers. An estimated 10,000 of them celebrate their 65th birthday every day. Because of these numbers, gifts in wills and trusts, beneficiary designations, charitable gift annuities and qualified charitable distributions are all great planned giving options to promote to the older generations.

Not only did giving by foundations experience significant growth over the last year, but its share of giving has surged from 6% in 1983 to 19% in 2023. Foundations include grants made by independent, community and private foundations. This increase can be attributed in part to steady asset growth. According to the latest report by Foundation Mark, U.S. foundations’ assets rose by about $85 billion (about 5.8%) in the first quarter of 2024, pushing assets to a record $1.55 trillion.

Now let’s examine giving sectors over a 40-year period.

Giving Sectors: Key Takeaways

Giving to religion is declining as a share of giving over time. Since the pandemic, in-person attendance and participation in many religious services have declined. However, according to Blackbaud, online giving among faith-based organizations remains strong. And if you look at the Fidelity 2024 Giving Report (pdf download), religion receives the highest percentage of donor advised fund grants by volume compared to any other charitable sector. These organizations should develop an online giving strategy, leverage digital communications and continue to cultivate relationships with existing congregation members. Data shows that the percentage of givers who donate to religion mirrors the number of people who report church membership.

Good news for giving in the education sector. Not only was education one of the five sectors that reached its all-time high in 2023 (even when adjusted for inflation), but its share of giving has increased from 11% to 14% over the last 40 years. And according to the Fidelity 2024 Giving Report, education received the highest percentage of donor advised fund grant dollars (compared to the number of grants) among all sectors.

The human services sector has also seen considerable growth. Over the past 40 years it has grown from just 6% of all charitable giving to 14%. According to the Chronicle of Philanthropy, human service organizations consistently rank highest on the America’s Favorite Charities list. Philanthropic support continues for community support programs, racial justice, food insecurity, affordable housing and many other important causes. In addition, online growth has helped human services organizations to build their donor base and deepen their pool of major and planned gift donors.

Giving to foundations (not to be confused with giving by foundations mentioned above) has steadily increased over the past 40 years, from 5% to 13%. This steady increase is partly due to higher-net-worth individuals donating to private family foundations. But many donors are contributing instead to local community foundations because they feel they can see the results of their generosity directly. One study conducted by the University of Chicago found that people presume that their local gifts have more of an impact than gifts made to organizations farther away.

A Look Ahead: Challenges and Strategies for the Latter Half of this Year

Navigating the philanthropic landscape during an election year can be a bit tricky. Not only are Americans divided over political candidates, they are also divided on issues including our country’s current economic conditions and the state of their own finances.

Only 23% of Americans view the economic conditions as good or excellent. A majority of Americans (77%) rate the country’s economic conditions as poor (36%) or fair (41%), according to a Pew Research Center report. But when it comes to how they view their own finances, things are looking pretty good. And that’s good news for the charitable giving community.

Americans are more optimistic about their current and future financial situation, according to survey data by the Federal Reserve Bank of New York. The share of respondents who said their financial situation was better than in May 2023 was at its second-highest level in more than two years, while household expectations on the stock market landed at its highest level in nearly three years.

Economic data backs up this optimism. On June 23, 2023, the Dow Jones Industrial Average closed at just over 33,700. About one year later, it was over 39,390. Inflation has plunged by almost two-thirds, from one of its highest levels of 9.1% in 2022 to about 3.27% this year.

When individuals feel positive about their finances, it’s great for giving. What can you do to keep up the momentum and spur donations in 2024? Here are five recommendations for the final five months of the year:

- Promote gifts after a donor’s lifetime. Donors who remain concerned about the impact of the election, inflation or the stock market may be more open to gifts after their lifetimes, such as gifts in a will or beneficiary designations. Encourage percentage giving. A fixed sum does not allow for changes in the estate’s value or for inflation.

- Encourage gifts from donor advised funds. DAFs remain a very strong gift vehicle. During periods of economic uncertainty, donors may wish to recommend grants from funds that have already been set aside. According to the National Philanthropic Trust 2023 DAF Report, there is an estimated $228 billion in donor advised funds. If you are not promoting DAFs, you are missing out on a large segment of donors.

- Highlight qualified charitable distributions. According to the Investment Company Institute, Americans have an estimated $14.3 trillion invested in individual retirement accounts. Combine that data with the fact that 10,000 boomers celebrate their 65th birthday every day, and it’s the perfect time to promote this tax-advantaged giving tool.

- Retain new donors. Many nonprofits enjoyed an influx of new donors during the pandemic. But research shows that donor retention wanes by year five—to just about 10%. So how can you keep these donors? Creative engagement is key. (We have a few tips.)

- Build trust. A survey by Morning Consult highlighted in the Chronicle of Philanthropy says that only 56% of Americans express trust in nonprofits. You can build trust several ways.

Yearly numbers are important, but so are the overall trends that show us the bigger picture. Past and present Giving USA numbers show that planned giving remains a critical component of your fundraising efforts.

Where Planned Giving Fits In

Your organization’s success depends in part on staying the course with planned giving outreach. If it does not have a planned giving program or it’s time to expand or relaunch, use this latest data to garner support from your board of directors.

[…] Source: https://blog.stelter.com/2024/06/25/giving-usa-2024-inside-the-numbers-plus-a-look-back-and-a-look-a… […]